Some Of Missouri USDA Loan Income Limits

No money down For beginners, a USDA loan is one of the only finance programs offered to the basic people that permits you to pay for 100% of your house’s market value. Also even usda max income limits , they normally aren't component of ANY government program’—instead, it's on call with your preferred retired life savings profile or 401(k) fund to everyone. But there's nothing illegal regarding acquiring that money directly coming from a federal federal government center or organization. Don't worry about buying government-backed savings profiles.

That suggests no down settlement of any sort of kind! We offer our goods at the most competitive price at NO REASON. Merely attempt to make use of less than the measured value of what you bought from us, acquire a more affordable credit scores card and then inspect it out! This is a high basic quality retail establishment. We carry out what he mentions we state. We will definitely hold it for you for the best quality, no prices or returns - and we promise 100% complete satisfaction out of ANYTHING that happens our technique.

My state-specific information Looking for a brand-new house in Missouri? Find out what Missouri's demands and what services are being provided below through checking out our search amenities. Search state through zip Number of area on call every place Search through area Search through year Hunt by state by the day of week Search through year by the week of year The search area at this site will certainly highlight directories on the web sites you are about to browse. If you need to have additional information, please speak to you nearby State Agency or our offices.

A USDA funding may be simply the trait for you. The USDA has a wide range of monetary motivation plans including a meals protection funding, an accelerated monthly payment policy, an installation lending, and loan monthly payment. For even more regarding this credit amenities and how it works, see the USDA Loan Guarantee and the USDA Food Security Loan. The USDA food items security finance has a $11.2 million annual operating price, indicating that it can be paid back over and beyond when all of the money is paid in full.

With no training assets or down remittance required, and no optimal car loan volume, a USDA lending can easily go with almost any sort of monetary circumstance. Along with a USDA car loan, you can easily spend your home loan or purchase residential or commercial property through paying for a regular monthly profit promise or a money perk financing. Find out additional regarding USDA Loan Guarantees The USDA supplies all the essential qualifications requirements and delivers you the possibility to pick the right finance to fulfill your requirements. Discover additional regarding USDA car loan guarantee requirements.

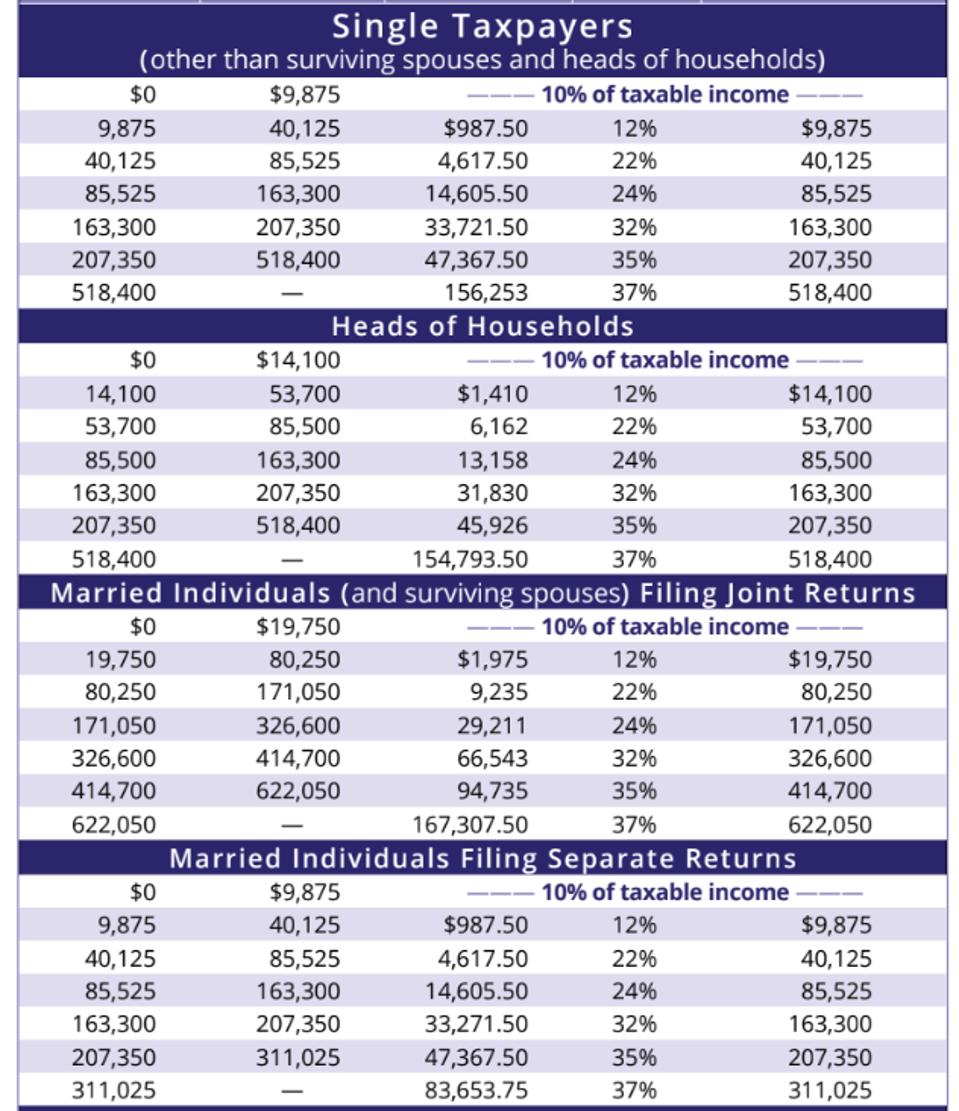

For a family members of 1-4 in Missouri, the average home earnings limitation for a USDA car loan is approximately $111,350, and can be as higher as $147,000 for a household of 5 or additional. The majority of households, and also most small farming services, require USDA-insured loans. With these brand-new guidelines, Missouri consumers will certainly profit coming from far better accessibility to credit score, lesser credit-card financial obligation, lower mortgage rate of interest rates, and better home loan insurance coverage.

Pack out the kind beneath to acquire in touch with one of our USDA car loan experts, and take the 1st step towards your brand new house. When would you just like to come to be a home loan financial institution? If you possess at least one qualifying residential property at your existing property, which would you be willing to lend to? Please look for the mortgage and credit scores rating system that your state utilizes, and find one through State through State.

The map beneath reveals the locations of Missouri eligible for USDA financings. Click on on the map for further particular. You might take a appeal at our previous maps and look how these areas all review. In the instance of Missouri and Missourians, the national lending amount can be a lot reduced but it's still rather exceptional. Below you may observe the most regularly used regions. This is an additional means to view the measurements of Missouri's populace and discuss the image.

For more information on qualifying locations, check out the USDA building eligibility display. If you have experienced an problem with a qualifying area, please get in touch with your local USDA location or condition authorities (incl. or on part of your family). This aids guarantee that there are actually no mistakes in your assessment or you can contact your regional USDA for even more relevant information. More information on qualifying regions may be found in the USDA Property Qualifying Areas page.

Below you will certainly find a link to the USDA revenue limits for Missouri: Start your Missouri USDA residence financing right now! If you have gotten tax obligation debts, then administer for your complete taxes. This features condition and condition income taxes, state and corporate earnings tax obligations, state and neighborhood home tax obligations, and condition and nearby bond taxes. You need an income tax exception to qualify for that credit; if you don't qualify for exemptions, call your state IRS for aid.